Insurance from the Knights of Columbus

Contact our Council Insurance agent:

Doug Helderop (734) 276-6925

[email protected]

3/8/2022 - A message from our Insurance Agent...

I would like to introduce myself as your new field agent. I’m an active parishioner with Christ the King in Ann Arbor and live in Superior Township.

I joined the Knights because I believe in Fr. McGivney’s mission, “To render financial aid to its members and the beneficiaries of members.”

I’m excited about the renewed dedication of the Knights in uniting families in service to the Church, the community, and our fellow man; including encouraging men to be better husbands, fathers and leaders in their church and community.

When was the last time you reviewed your family’s financial plan? Do you know we offer retirement planning as part of your benefits? Are your beneficiaries up to date? Are you aware of the new benefits the Knights of Columbus offer?

I would like to check the details of all of the policies you have with any company so that I will always be in a position to render prompt and efficient service.

I will call soon to arrange a free "family security checkup".

Sincerely and fraternally,

I would like to introduce myself as your new field agent. I’m an active parishioner with Christ the King in Ann Arbor and live in Superior Township.

I joined the Knights because I believe in Fr. McGivney’s mission, “To render financial aid to its members and the beneficiaries of members.”

I’m excited about the renewed dedication of the Knights in uniting families in service to the Church, the community, and our fellow man; including encouraging men to be better husbands, fathers and leaders in their church and community.

When was the last time you reviewed your family’s financial plan? Do you know we offer retirement planning as part of your benefits? Are your beneficiaries up to date? Are you aware of the new benefits the Knights of Columbus offer?

I would like to check the details of all of the policies you have with any company so that I will always be in a position to render prompt and efficient service.

I will call soon to arrange a free "family security checkup".

Sincerely and fraternally,

6/8/2021 - A message from our Insurance Agent...

Brothers,

Spring is here, we have a new season and after a blessed Easter and a beautiful Eastertide, it's time to start planning again. With spring and some break in the weather, I've started to put together my honey-do list that will take me outside into the sunshine…at least I hope it's going to be sunny when I get outdoors to do all these chores. I don't know about you, but this time of year seems to energize me. After being cooped up all winter, and this year really being cooped up, I've been able to think of all the things I need to get done. Some of that includes planting the garden, adding some chickens to our flock, we even added two cows this spring to go along with the hundreds of meat chickens we raise each year. I've had some estimates for work I need done around the house. Every craftsman has told me their business is booming. So many people have noticed things that need to be done around the house since they've been inside for the better part of a year.

And as you sit around and consider all the things that you need to get updated, let me make a suggestion that may put your mind and your family's mind at ease. We know this year has been unpredictable in many ways, but let’s be honest, pandemic or not, life is unpredictable. We can’t see what the future will bring, but we can plan for the unexpected. Remember that as a member of the Knights of Columbus I am your partner on your journey to prepare for and face the unpredictable.

Just as we take stock of the physical changes that need to be considered, I'd suggest that you take stock of where you stand protecting your family. The Knights of Columbus has partnered with industry leader Advicent to help us help you. I can use Advicent’s state-of-the-art software to provide you with a comprehensive financial needs analysis. With it I can help you take stock of where you are today, where you want to go, and how close you are to achieving your goals. I can help you identify any gaps in your coverage or issues you should address. This will give you a comprehensive look at where you stand. While many other companies charge for this kind of service, the Order has invested in this software to help us agents help our members. This financial needs analysis is free of charge as a fraternal benefit of membership.

I feel I have a special bond of brotherhood with all my members and I am committed to helping protect Catholic families…your family…while furthering the vision of Blessed Michael McGivney. Please take time to meet with me and take advantage of this free benefit of membership.

Vivat Jesu!

Be Safe, stay safe, and know your risk.

God Bless you and your family,

T.J. McCully

Field Agent

Knights of Columbus

Brothers,

Spring is here, we have a new season and after a blessed Easter and a beautiful Eastertide, it's time to start planning again. With spring and some break in the weather, I've started to put together my honey-do list that will take me outside into the sunshine…at least I hope it's going to be sunny when I get outdoors to do all these chores. I don't know about you, but this time of year seems to energize me. After being cooped up all winter, and this year really being cooped up, I've been able to think of all the things I need to get done. Some of that includes planting the garden, adding some chickens to our flock, we even added two cows this spring to go along with the hundreds of meat chickens we raise each year. I've had some estimates for work I need done around the house. Every craftsman has told me their business is booming. So many people have noticed things that need to be done around the house since they've been inside for the better part of a year.

And as you sit around and consider all the things that you need to get updated, let me make a suggestion that may put your mind and your family's mind at ease. We know this year has been unpredictable in many ways, but let’s be honest, pandemic or not, life is unpredictable. We can’t see what the future will bring, but we can plan for the unexpected. Remember that as a member of the Knights of Columbus I am your partner on your journey to prepare for and face the unpredictable.

Just as we take stock of the physical changes that need to be considered, I'd suggest that you take stock of where you stand protecting your family. The Knights of Columbus has partnered with industry leader Advicent to help us help you. I can use Advicent’s state-of-the-art software to provide you with a comprehensive financial needs analysis. With it I can help you take stock of where you are today, where you want to go, and how close you are to achieving your goals. I can help you identify any gaps in your coverage or issues you should address. This will give you a comprehensive look at where you stand. While many other companies charge for this kind of service, the Order has invested in this software to help us agents help our members. This financial needs analysis is free of charge as a fraternal benefit of membership.

I feel I have a special bond of brotherhood with all my members and I am committed to helping protect Catholic families…your family…while furthering the vision of Blessed Michael McGivney. Please take time to meet with me and take advantage of this free benefit of membership.

Vivat Jesu!

Be Safe, stay safe, and know your risk.

God Bless you and your family,

T.J. McCully

Field Agent

Knights of Columbus

Thursday - April 23, 2020 - A message from Grand Knight, Larry Guastella...

Brothers,

For our council members that are Insurance members, this information is directed toward you. During this difficult time, many of us are making choices, adjustments and sacrifices regarding our financial needs. As a member of the Knights of Columbus Insurance Program, there are options for brothers in need of financial assistance or hardship. I spoke with our council insurance agent Paul Ruede earlier this week and he is available to discuss possible options that may support your situation.

Please feel free to reach out to him using the contact information below. He is here to support our council!

Paul Ruede

517-750-7018

[email protected]

Vivat Jesus,

Larry Guastella, Grand Knight

Msgr. Clement H. Kern Council #8284

555 S. Lilley Road

Canton, MI 48188

734-674-7413

Brothers,

For our council members that are Insurance members, this information is directed toward you. During this difficult time, many of us are making choices, adjustments and sacrifices regarding our financial needs. As a member of the Knights of Columbus Insurance Program, there are options for brothers in need of financial assistance or hardship. I spoke with our council insurance agent Paul Ruede earlier this week and he is available to discuss possible options that may support your situation.

Please feel free to reach out to him using the contact information below. He is here to support our council!

Paul Ruede

517-750-7018

[email protected]

Vivat Jesus,

Larry Guastella, Grand Knight

Msgr. Clement H. Kern Council #8284

555 S. Lilley Road

Canton, MI 48188

734-674-7413

12/4/2017 - A note from our Insurance Agent

Brother Knights,

"O Come, O Come Emanuel, and ransom captive Israel"

Every year at this time, the Church calls us to pause and reflect on the wonder and mystery of the birth of our Lord, Jesus Christ.

As the season of Advent approaches, I would like to express to you and your entire family my heartfelt prayers and wishes for your health and safety.

I hope that whenever your financial needs and the needs of your family come to mind, that you will remember the Knights of Columbus. Thank you so very much for your continuing support and commitment to the goals and concerns that we both share as members of the Knights of Columbus.

God Bless you and your family. I wish you a very happy and blessed Advent and Christmas celebration.

Sincerely and fraternally,

Greg Rapelje

Knights of Columbus

Field Agent

11292 Hubbell St.

Livonia, MI 48150

Phone/Txt 734-474-8398

Fax 888-880-9708

Brother Knights,

"O Come, O Come Emanuel, and ransom captive Israel"

Every year at this time, the Church calls us to pause and reflect on the wonder and mystery of the birth of our Lord, Jesus Christ.

As the season of Advent approaches, I would like to express to you and your entire family my heartfelt prayers and wishes for your health and safety.

I hope that whenever your financial needs and the needs of your family come to mind, that you will remember the Knights of Columbus. Thank you so very much for your continuing support and commitment to the goals and concerns that we both share as members of the Knights of Columbus.

God Bless you and your family. I wish you a very happy and blessed Advent and Christmas celebration.

Sincerely and fraternally,

Greg Rapelje

Knights of Columbus

Field Agent

11292 Hubbell St.

Livonia, MI 48150

Phone/Txt 734-474-8398

Fax 888-880-9708

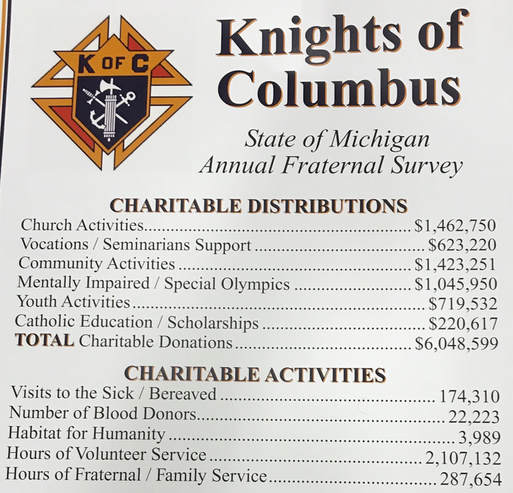

Thursday - August 17, 2017 - Field Agent Greg Rapelje reviewed the accomplishments of the Knights of Columbus in the State of Michigan over the past fraternal year at last night's Kern Council general meeting. As Knights, we can be proud of all the time and money spent in promoting the principles of our order last year! Great work, men!

7/6/2017 - A note from our Insurance Agent

The Value of Life Insurance for Children

Dear Brother Knight,

The Value of Life Insurance for Children

As a father, you worry about your children and do everything you can to protect them. You try to raise them right and make sure they are prepared to become adults. But have you ever thought about buying life insurance for your child?

When you insure a child, you are protecting his or her future. Did you know that one out of every six adults get rated, postponed, or denied for insurance coverage? If you purchase a policy for your child from the Knights of Columbus with a guaranteed purchase option, it guarantees that more insurance can be purchased for that child at certain set dates, without proving insurability.

Unfortunately, as fathers we don’t have a crystal ball, and we don’t know what the future may have in store for our children’s health. But did you know that right now you can purchase a child’s policy, in many cases, for less than $10 a month?

I’ve heard it said that people don’t want to “profit” from the death of a child, so they won’t purchase coverage on their children. God forbid something tragic happens, those funds can come in handy at a time when finances will be the last thing on a parent’s mind. I have never heard a story about someone who regretted buying coverage on their child.

Contact me today to discuss the many policy options for child plans, including 10- and 20-Pay life insurance.

I hope you had a Happy and Safe 4th.

Blessings to you and your family,

Sincerely,

Greg Rapelje, Field Agent

Knights of Columbus

11292 Hubbell St.

Livonia, MI 48150

Phone 734-474-8398

Fax 888-880-9708

The Value of Life Insurance for Children

Dear Brother Knight,

The Value of Life Insurance for Children

As a father, you worry about your children and do everything you can to protect them. You try to raise them right and make sure they are prepared to become adults. But have you ever thought about buying life insurance for your child?

When you insure a child, you are protecting his or her future. Did you know that one out of every six adults get rated, postponed, or denied for insurance coverage? If you purchase a policy for your child from the Knights of Columbus with a guaranteed purchase option, it guarantees that more insurance can be purchased for that child at certain set dates, without proving insurability.

Unfortunately, as fathers we don’t have a crystal ball, and we don’t know what the future may have in store for our children’s health. But did you know that right now you can purchase a child’s policy, in many cases, for less than $10 a month?

I’ve heard it said that people don’t want to “profit” from the death of a child, so they won’t purchase coverage on their children. God forbid something tragic happens, those funds can come in handy at a time when finances will be the last thing on a parent’s mind. I have never heard a story about someone who regretted buying coverage on their child.

Contact me today to discuss the many policy options for child plans, including 10- and 20-Pay life insurance.

I hope you had a Happy and Safe 4th.

Blessings to you and your family,

Sincerely,

Greg Rapelje, Field Agent

Knights of Columbus

11292 Hubbell St.

Livonia, MI 48150

Phone 734-474-8398

Fax 888-880-9708

12/7/2016 - A note from our Insurance Agent

Update Your Beneficiaries

Sometimes it is easy to overlook the simplest of things.

Take, for example, the beneficiaries on your life insurance policies. If your policy was applied for and issued several years ago, it may very well be that the person you originally selected as the beneficiary is no longer the person you would want to receive the policy proceeds. If you bought the policy when you were single, for example, you may have named your parents as beneficiaries. If you have since married, your policies should be updated to reflect your spouse as beneficiary. Maybe you’ve had children since, who are not named on the policies.

Most people list a primary beneficiary, who is specifically designated as the first in priority to receive policy proceeds. We also encourage the naming of a contingent beneficiary, an alternate person designated to receive policy proceeds, usually in the event that the original beneficiary pre-deceases the insured.

I routinely call all of my policyholders for annual review appointments, usually near the anniversary date of your policy – that is, the date it was originally issued. One of the matters that I’ll discuss during this review is the status of your beneficiary designations. If they need updating, and they often do, I can complete the paperwork during that appointment.

Sincerely,

Greg Rapelje, Field Agent

Knights of Columbus

11292 Hubbell St.

Livonia, MI 48150

Phone 734-474-8398

Fax 888-880-9708

Update Your Beneficiaries

Sometimes it is easy to overlook the simplest of things.

Take, for example, the beneficiaries on your life insurance policies. If your policy was applied for and issued several years ago, it may very well be that the person you originally selected as the beneficiary is no longer the person you would want to receive the policy proceeds. If you bought the policy when you were single, for example, you may have named your parents as beneficiaries. If you have since married, your policies should be updated to reflect your spouse as beneficiary. Maybe you’ve had children since, who are not named on the policies.

Most people list a primary beneficiary, who is specifically designated as the first in priority to receive policy proceeds. We also encourage the naming of a contingent beneficiary, an alternate person designated to receive policy proceeds, usually in the event that the original beneficiary pre-deceases the insured.

I routinely call all of my policyholders for annual review appointments, usually near the anniversary date of your policy – that is, the date it was originally issued. One of the matters that I’ll discuss during this review is the status of your beneficiary designations. If they need updating, and they often do, I can complete the paperwork during that appointment.

Sincerely,

Greg Rapelje, Field Agent

Knights of Columbus

11292 Hubbell St.

Livonia, MI 48150

Phone 734-474-8398

Fax 888-880-9708

9/21/2016 - A note from our Insurance Agent

Long Term Care Plans Offer Peace of Mind

Since its addition to the Order’s product portfolio in 2000, long-term care (LTC) insurance has provided the Knights of Columbus with an excellent opportunity to further serve members and their families. And, for our long-term care policy holders in the United States, there’s an added bonus.

It’s called “Provider Pathway,” a program offering access to a network of long-term care providers at discounted rates. The network includes discounts on products, such as hearing aids, diabetic supplies, personal emergency response systems, and durable medical equipment, as well as skilled nursing facilities, assisted living, and adult day care.

Eligibility for participation in this program is open to Knights of Columbus long-term care insurance policyholders, their spouses, dependent children, parents and parents-in-law. All providers are fully credentialed and meet state licensing requirements.

If you haven’t yet spoken with me about long-term care insurance, you owe it to yourself to do so. There are a few decisions to make in choosing a “plan” — a comprehensive plan that covers care whether you’re at home or in a facility, or one that covers facility only; daily benefit amounts and benefit durations (how much and how long it will last); and the length of the elimination period (waiting period) before benefits kick-in.

Having a professionally trained agent ― and a brother Knight you can trust ― to help guide you through the process is yet another valuable benefit that comes with your membership. Take advantage of it; contact me today.

Have a Blessed Day,

Greg Rapelje, Field Agent

Knights of Columbus

11292 Hubbell St.

Livonia, MI 48150

Phone 734-474-8398

Fax 888-880-9708

Long Term Care Plans Offer Peace of Mind

Since its addition to the Order’s product portfolio in 2000, long-term care (LTC) insurance has provided the Knights of Columbus with an excellent opportunity to further serve members and their families. And, for our long-term care policy holders in the United States, there’s an added bonus.

It’s called “Provider Pathway,” a program offering access to a network of long-term care providers at discounted rates. The network includes discounts on products, such as hearing aids, diabetic supplies, personal emergency response systems, and durable medical equipment, as well as skilled nursing facilities, assisted living, and adult day care.

Eligibility for participation in this program is open to Knights of Columbus long-term care insurance policyholders, their spouses, dependent children, parents and parents-in-law. All providers are fully credentialed and meet state licensing requirements.

If you haven’t yet spoken with me about long-term care insurance, you owe it to yourself to do so. There are a few decisions to make in choosing a “plan” — a comprehensive plan that covers care whether you’re at home or in a facility, or one that covers facility only; daily benefit amounts and benefit durations (how much and how long it will last); and the length of the elimination period (waiting period) before benefits kick-in.

Having a professionally trained agent ― and a brother Knight you can trust ― to help guide you through the process is yet another valuable benefit that comes with your membership. Take advantage of it; contact me today.

Have a Blessed Day,

Greg Rapelje, Field Agent

Knights of Columbus

11292 Hubbell St.

Livonia, MI 48150

Phone 734-474-8398

Fax 888-880-9708

8/5/2016 - A note from our Insurance Agent

Protecting Widows – A Founding Goal

As a member of this council, you know how important spouses can be to the charitable works of the Order. If you’re married, your wife is probably involved in a few of the many events that happen each fraternal year. This support adds great value and impact to what a council can achieve.

When the Order was founded in 1882, Father Michael J. McGivney and the other brave men were setting out to protect Catholic families, but especially wives and children. Today, we remain committed to this mission by offering insurance products and fraternal benefits designed with that goal in mind. One specific policy rider that you may not know about is called Spousal Waiver of Premium. This rider is unique to the Knights of Columbus philosophy of helping our widows.

This rider is available on most permanent and Discoverer plans purchased at standard rates by a member and his wife on the same day. When both spouses apply, the rider provides for waiver of premiums on the spouse’s contract in the event of the insured’s death. Best of all, for members and spouses ages 18 to 60, this waiver can be added for no charge. The rider stays in effect until the spouse attains age 65 or certain other triggering events occur.

Our products are designed with your needs and budget in mind. With a solid portfolio of life insurance, long-term care, disability income and retirement products, the Knights of Columbus can help you meet all of your financial goals. To learn more about these solutions, contact me today.

Have a Blessed Day,

Greg Rapelje, Field Agent

Knights of Columbus

11292 Hubbell St.

Livonia, MI 48150

Phone 734-474-8398

Fax 888-880-9708

Protecting Widows – A Founding Goal

As a member of this council, you know how important spouses can be to the charitable works of the Order. If you’re married, your wife is probably involved in a few of the many events that happen each fraternal year. This support adds great value and impact to what a council can achieve.

When the Order was founded in 1882, Father Michael J. McGivney and the other brave men were setting out to protect Catholic families, but especially wives and children. Today, we remain committed to this mission by offering insurance products and fraternal benefits designed with that goal in mind. One specific policy rider that you may not know about is called Spousal Waiver of Premium. This rider is unique to the Knights of Columbus philosophy of helping our widows.

This rider is available on most permanent and Discoverer plans purchased at standard rates by a member and his wife on the same day. When both spouses apply, the rider provides for waiver of premiums on the spouse’s contract in the event of the insured’s death. Best of all, for members and spouses ages 18 to 60, this waiver can be added for no charge. The rider stays in effect until the spouse attains age 65 or certain other triggering events occur.

Our products are designed with your needs and budget in mind. With a solid portfolio of life insurance, long-term care, disability income and retirement products, the Knights of Columbus can help you meet all of your financial goals. To learn more about these solutions, contact me today.

Have a Blessed Day,

Greg Rapelje, Field Agent

Knights of Columbus

11292 Hubbell St.

Livonia, MI 48150

Phone 734-474-8398

Fax 888-880-9708

3/31/2016 - A note from our Insurance Agent

Only Having Insurance “Through Work” Doesn’t Work

Do you know anyone whose life or career has drastically changed during these years of economic downturn? It’s very likely that someone in your immediate or extended family or group of friends is facing financial uncertainty. Maybe there’s a possibility that you (or your spouse) could lose your job or change employers.

Too many people have often relied on group term life insurance as their only safety net. Often, this insurance is an employee benefit provided at low or no cost. The existence of this coverage might convince someone that personally-owned life insurance is not necessary.

But only having “through work” insurance can leave you and your family vulnerable. Most group life insurance policies are limited in amount, which may be tied to salary or some other benchmark. These numbers are often capped, and this cap may be dangerously low when compared to your family’s actual needs. In fact, a detailed needs analysis that evaluates your specific situation, will likely show that any employer-provided coverage falls short.

In addition, the amount of group insurance offered is almost always reduced, sometimes dramatically, when you retire. You could one day find yourself without coverage, and if your health has changed (which it will as you age), you might also find yourself unable to secure individual protection. At the very least, it will definitely be more expensive.

While group life insurance can help, it does not replace the need for individually owned life insurance. I’ll be happy to meet with you and provide a no-cost needs analysis, so you’ll know exactly where you stand.

Sincerely,

Greg Rapelje

Knights of Columbus

Field Agent

11292 Hubbell St.

Livonia, MI 48150

734-474-8398

Fax 888-880-9708

[email protected]

Only Having Insurance “Through Work” Doesn’t Work

Do you know anyone whose life or career has drastically changed during these years of economic downturn? It’s very likely that someone in your immediate or extended family or group of friends is facing financial uncertainty. Maybe there’s a possibility that you (or your spouse) could lose your job or change employers.

Too many people have often relied on group term life insurance as their only safety net. Often, this insurance is an employee benefit provided at low or no cost. The existence of this coverage might convince someone that personally-owned life insurance is not necessary.

But only having “through work” insurance can leave you and your family vulnerable. Most group life insurance policies are limited in amount, which may be tied to salary or some other benchmark. These numbers are often capped, and this cap may be dangerously low when compared to your family’s actual needs. In fact, a detailed needs analysis that evaluates your specific situation, will likely show that any employer-provided coverage falls short.

In addition, the amount of group insurance offered is almost always reduced, sometimes dramatically, when you retire. You could one day find yourself without coverage, and if your health has changed (which it will as you age), you might also find yourself unable to secure individual protection. At the very least, it will definitely be more expensive.

While group life insurance can help, it does not replace the need for individually owned life insurance. I’ll be happy to meet with you and provide a no-cost needs analysis, so you’ll know exactly where you stand.

Sincerely,

Greg Rapelje

Knights of Columbus

Field Agent

11292 Hubbell St.

Livonia, MI 48150

734-474-8398

Fax 888-880-9708

[email protected]

2/22/2016 - A note from our Insurance Agent

Plan for this Tax Day and into the Future

April 15 (tax day) is right around the corner. It’s become popular this time of year to encourage the opening of an IRA or similar retirement annuity, or the depositing of additional funds into an existing account, as a tax-savings vehicle. Or perhaps someone has tried to convince you to open an account, touting the rate of interest that money in one of these accounts can earn. Let me join the chorus of folks encouraging you to open or add funds to an annuity, but for a different reason.

Certainly, contributing money to a Knights of Columbus annuity will allow you to save some money on your income tax return. And, our annuities do pay a very competitive interest rate, consistent with our primary goal of absolute safety of principal. Opening or adding to an annuity for these reasons, however, strikes me as taking a short-term view of a product that is designed to provide long-term security. How much security? How does retirement income that you cannot outlive — guaranteed — sound to you?

Here at the Knights of Columbus, you can open a retirement annuity for as little as $300. Consistent and disciplined savings placed into that annuity over time can guarantee you an income at retirement that you cannot outlive. That guarantee — along with the fact that no one has ever lost money left in a Knights of Columbus annuity (remember – absolute safety of principal) — really will provide you with peace of mind.

I am happy to meet with you – at your convenience and in your home – to explain in detail the benefits of opening a Knights of Columbus annuity, along with the benefits of our top-rated life insurance, disability income and long-term care insurance plans.

Sincerely,

Greg Rapelje

Knights of Columbus

Field Agent

11292 Hubbell St.

Livonia, MI 48150

734-474-8398

Fax 888-880-9708

[email protected]

Plan for this Tax Day and into the Future

April 15 (tax day) is right around the corner. It’s become popular this time of year to encourage the opening of an IRA or similar retirement annuity, or the depositing of additional funds into an existing account, as a tax-savings vehicle. Or perhaps someone has tried to convince you to open an account, touting the rate of interest that money in one of these accounts can earn. Let me join the chorus of folks encouraging you to open or add funds to an annuity, but for a different reason.

Certainly, contributing money to a Knights of Columbus annuity will allow you to save some money on your income tax return. And, our annuities do pay a very competitive interest rate, consistent with our primary goal of absolute safety of principal. Opening or adding to an annuity for these reasons, however, strikes me as taking a short-term view of a product that is designed to provide long-term security. How much security? How does retirement income that you cannot outlive — guaranteed — sound to you?

Here at the Knights of Columbus, you can open a retirement annuity for as little as $300. Consistent and disciplined savings placed into that annuity over time can guarantee you an income at retirement that you cannot outlive. That guarantee — along with the fact that no one has ever lost money left in a Knights of Columbus annuity (remember – absolute safety of principal) — really will provide you with peace of mind.

I am happy to meet with you – at your convenience and in your home – to explain in detail the benefits of opening a Knights of Columbus annuity, along with the benefits of our top-rated life insurance, disability income and long-term care insurance plans.

Sincerely,

Greg Rapelje

Knights of Columbus

Field Agent

11292 Hubbell St.

Livonia, MI 48150

734-474-8398

Fax 888-880-9708

[email protected]

2/25/2015 - A note from our Insurance Agent

Have You Insured Your Most Valuable Asset?

Is your income protected if you become sick or injured and cannot work? Your ability to work and earn an income is your most valuable asset. Yet a disability could prevent you from earning that income. Just one year of a disability could eliminate your savings.

Income Armor, an individual disability income insurance product from the Knights of Columbus, should be a key part of your overall financial plan and family’s protection.

If you are ill or injured, Income Armor provides tax-free monthly benefits to help you meet living expenses and maintain you and your family’s standard of living. Your monthly benefits help you pay your mortgage and other monthly bills, while your savings and retirement assets remain intact.

In short, if you have a job and don’t have a way to protect that paycheck, you should seriously consider Income Armor today. I look forward to meeting with you.

Don't Assume You Can't Afford Disability Income Insurance

One of the biggest mistakes you can make regarding disability insurance is to assume you can't afford it or you won't qualify. Before you make that assumption, do some basic research and apply for coverage through the Knights of Columbus. The Order’s Income Armor product gives you options that can help you fit this critical protection into your risk management budget.

Here are two ways you can reduce your premium:

1. Choose a two-year or five-year maximum benefit period.

Depending on your age, the best option is probably a policy that pays benefits until you reach age 67. But a two-year or five-year duration benefit period would cover disabilities you might encounter in your working life.

2. Choose a longer elimination period.

An elimination period is the number of days a total disability must exist before benefits begin to accrue. Typical elimination periods are 30, 90, or 180 days. Choosing a longer elimination period lowers the policy’s premium. But be sure you have enough set aside in your contingency fund to account for the longer gap.

As your professional insurance agent, risk management is my specialty. Let’s talk about how to protect your income, your retirement needs, and your family's financial future.

Greg Rapelje

Field Agent

734-474-8398 Cell/Text

[email protected]

Have You Insured Your Most Valuable Asset?

Is your income protected if you become sick or injured and cannot work? Your ability to work and earn an income is your most valuable asset. Yet a disability could prevent you from earning that income. Just one year of a disability could eliminate your savings.

Income Armor, an individual disability income insurance product from the Knights of Columbus, should be a key part of your overall financial plan and family’s protection.

If you are ill or injured, Income Armor provides tax-free monthly benefits to help you meet living expenses and maintain you and your family’s standard of living. Your monthly benefits help you pay your mortgage and other monthly bills, while your savings and retirement assets remain intact.

In short, if you have a job and don’t have a way to protect that paycheck, you should seriously consider Income Armor today. I look forward to meeting with you.

Don't Assume You Can't Afford Disability Income Insurance

One of the biggest mistakes you can make regarding disability insurance is to assume you can't afford it or you won't qualify. Before you make that assumption, do some basic research and apply for coverage through the Knights of Columbus. The Order’s Income Armor product gives you options that can help you fit this critical protection into your risk management budget.

Here are two ways you can reduce your premium:

1. Choose a two-year or five-year maximum benefit period.

Depending on your age, the best option is probably a policy that pays benefits until you reach age 67. But a two-year or five-year duration benefit period would cover disabilities you might encounter in your working life.

2. Choose a longer elimination period.

An elimination period is the number of days a total disability must exist before benefits begin to accrue. Typical elimination periods are 30, 90, or 180 days. Choosing a longer elimination period lowers the policy’s premium. But be sure you have enough set aside in your contingency fund to account for the longer gap.

As your professional insurance agent, risk management is my specialty. Let’s talk about how to protect your income, your retirement needs, and your family's financial future.

Greg Rapelje

Field Agent

734-474-8398 Cell/Text

[email protected]

1/24/2015 - A note from our Insurance Agent

Insurance Check-Up for 2015

Where did 2014 go? It seems like it was summer yesterday and Easter was last week.

I hope you and your family had a great finish to 2014. Now, the first quarter of 2015 is flying by.

Hopefully, you’ve established a few goals for this year. I’ve learned a great tip regarding resolutions. First, write them down. It’s not too late if you haven’t already done this. Commit your goals to paper and post it someplace you will see it often. Writing down a goal is the first step towards achieving it. It may not make sense at first, but I’m sure you have heard stories of the success this simple task can bring. Whether your goal is to exercise more, give more to charity, read more or watch less television, you’re more likely to accomplish it if you write it down.

Second, resolve to have an expert look at your finances. I recommend that you have a team of experts help you, and I would love to be the first you sit with. Let’s schedule some time to meet together, and I, your professional Knights of Columbus insurance agent, will provide an “insurance check-up” (at no cost!) that will evaluate any gaps in your family’s life insurance protection. Now might be the perfect time to fill those gaps, not later. Keep in mind that unlike many other products, you don’t just need money to obtain life insurance; you also need good health, and no one knows when your health could change.

Did I mention my check-up is free of charge? When was the last time you received something for free that could provide value to you and your family for generations? Call me today.

Greg Rapelje

Field Agent

734-474-8398 Cell/Text

[email protected]

Insurance Check-Up for 2015

Where did 2014 go? It seems like it was summer yesterday and Easter was last week.

I hope you and your family had a great finish to 2014. Now, the first quarter of 2015 is flying by.

Hopefully, you’ve established a few goals for this year. I’ve learned a great tip regarding resolutions. First, write them down. It’s not too late if you haven’t already done this. Commit your goals to paper and post it someplace you will see it often. Writing down a goal is the first step towards achieving it. It may not make sense at first, but I’m sure you have heard stories of the success this simple task can bring. Whether your goal is to exercise more, give more to charity, read more or watch less television, you’re more likely to accomplish it if you write it down.

Second, resolve to have an expert look at your finances. I recommend that you have a team of experts help you, and I would love to be the first you sit with. Let’s schedule some time to meet together, and I, your professional Knights of Columbus insurance agent, will provide an “insurance check-up” (at no cost!) that will evaluate any gaps in your family’s life insurance protection. Now might be the perfect time to fill those gaps, not later. Keep in mind that unlike many other products, you don’t just need money to obtain life insurance; you also need good health, and no one knows when your health could change.

Did I mention my check-up is free of charge? When was the last time you received something for free that could provide value to you and your family for generations? Call me today.

Greg Rapelje

Field Agent

734-474-8398 Cell/Text

[email protected]

12/14/2014 - A note from our Insurance Agent

2014 Insurance Wrap-up...

Dear Brother Knights,

2014 is now mostly history. I have met with many of you and will continue to contact and schedule appointments with all my Brother Knights.

During 2014 in meeting with brothers I have offered three items, products, service and information, all three things have value. I have saved some of you money by using new products or updating your current plan with new information. I have helped many families have the protection of the safe and secure products offered by the Knights of Columbus. I have updated beneficiaries as needed and been available for questions. Some people have only received information on how they are currently protected. Sadly I have also had to meet with some families to process claims for brothers who have passed, this service I take very seriously.

For 2015 let me continue this journey of meeting all my Brother Knights and their families. If you want some information about me contact your council officers and ask them about your field agent. I truly have one goal; assist Brother Knights and their families.

My prayers to all of you for a healthy and prosperous 2015.

Sincerely,

Greg Rapelje

Field Agent

734-474-8398 Cell/Text

Email: [email protected]

2014 Insurance Wrap-up...

Dear Brother Knights,

2014 is now mostly history. I have met with many of you and will continue to contact and schedule appointments with all my Brother Knights.

During 2014 in meeting with brothers I have offered three items, products, service and information, all three things have value. I have saved some of you money by using new products or updating your current plan with new information. I have helped many families have the protection of the safe and secure products offered by the Knights of Columbus. I have updated beneficiaries as needed and been available for questions. Some people have only received information on how they are currently protected. Sadly I have also had to meet with some families to process claims for brothers who have passed, this service I take very seriously.

For 2015 let me continue this journey of meeting all my Brother Knights and their families. If you want some information about me contact your council officers and ask them about your field agent. I truly have one goal; assist Brother Knights and their families.

My prayers to all of you for a healthy and prosperous 2015.

Sincerely,

Greg Rapelje

Field Agent

734-474-8398 Cell/Text

Email: [email protected]

11/24/2014 - A note from our Insurance Agent

Update Your Beneficiaries

Sometimes it is easy to overlook the simplest of things.

Take, for example, the beneficiaries on your life insurance policies. If your policy was applied for and issued several years ago, it may very well be that the person you originally selected as the beneficiary is no longer the person you would want to receive the policy proceeds. If you bought the policy when you were single, for example, you may have named your parents as beneficiaries. If you have since married, your policies should be updated to reflect your spouse as beneficiary. Maybe you’ve had children since, who are not named on the policies.

Most people list a primary beneficiary, who is specifically designated as the first in priority to receive policy proceeds. We also encourage the naming of a contingent beneficiary, an alternate person designated to receive policy proceeds, usually in the event that the original beneficiary pre-deceases the insured.

I routinely call all of my policyholders for annual review appointments, usually near the anniversary date of your policy – that is, the date it was originally issued. One of the matters that I’ll discuss during this review is the status of your beneficiary designations. If they need updating, and they often do, I can complete the paperwork during that appointment.

I look forward to meeting with each of you to discuss your family’s needs.

Greg Rapelje

(734) 474 8398

[email protected]

Update Your Beneficiaries

Sometimes it is easy to overlook the simplest of things.

Take, for example, the beneficiaries on your life insurance policies. If your policy was applied for and issued several years ago, it may very well be that the person you originally selected as the beneficiary is no longer the person you would want to receive the policy proceeds. If you bought the policy when you were single, for example, you may have named your parents as beneficiaries. If you have since married, your policies should be updated to reflect your spouse as beneficiary. Maybe you’ve had children since, who are not named on the policies.

Most people list a primary beneficiary, who is specifically designated as the first in priority to receive policy proceeds. We also encourage the naming of a contingent beneficiary, an alternate person designated to receive policy proceeds, usually in the event that the original beneficiary pre-deceases the insured.

I routinely call all of my policyholders for annual review appointments, usually near the anniversary date of your policy – that is, the date it was originally issued. One of the matters that I’ll discuss during this review is the status of your beneficiary designations. If they need updating, and they often do, I can complete the paperwork during that appointment.

I look forward to meeting with each of you to discuss your family’s needs.

Greg Rapelje

(734) 474 8398

[email protected]

10/28/2014 - A note from our Insurance Agent

Life Insurance As a Gift?

The initial reaction for many people when you mention life insurance as a gift is a quick step back and a questioning stare. “How morbid,” they think. While it may seem that way when you first mention it, life insurance is really a thoughtful gift that can be a financial life preserver in tough times.

The problem with life insurance is the general perception. Many think of death instead of the great benefits it provides, and the security that it offers – even while you’re alive. Life insurance should be thought of as a precautionary protective measure for a family unit. The purchase of this product can mean saving your home, sending your children to college, and preserving your spouse’s quality of life in the event of your death.

One of the times you may want to purchase life insurance for someone is when a family has a new baby. It’s a great, low-cost way to set money aside for the future (i.e. college tuition, housing, business start-up, etc.). Of greater importance, it ensures these children will have insurance as adults, in case an illness later in life makes him or her uninsurable.

Newlyweds are also ideal recipients for life insurance. As they join their lives and financial responsibilities, young couples need to make sure that their early investments are fully protected. If something were to happen to one of them, the other may be faced with serious financial hardship. A life insurance policy is an ideal way to ensure their future and protect their assets.

As nontraditional as it may be, life insurance is a wise and caring gift to purchase for many people.

Greg Rapelje

734-474-8398

[email protected]

Life Insurance As a Gift?

The initial reaction for many people when you mention life insurance as a gift is a quick step back and a questioning stare. “How morbid,” they think. While it may seem that way when you first mention it, life insurance is really a thoughtful gift that can be a financial life preserver in tough times.

The problem with life insurance is the general perception. Many think of death instead of the great benefits it provides, and the security that it offers – even while you’re alive. Life insurance should be thought of as a precautionary protective measure for a family unit. The purchase of this product can mean saving your home, sending your children to college, and preserving your spouse’s quality of life in the event of your death.

One of the times you may want to purchase life insurance for someone is when a family has a new baby. It’s a great, low-cost way to set money aside for the future (i.e. college tuition, housing, business start-up, etc.). Of greater importance, it ensures these children will have insurance as adults, in case an illness later in life makes him or her uninsurable.

Newlyweds are also ideal recipients for life insurance. As they join their lives and financial responsibilities, young couples need to make sure that their early investments are fully protected. If something were to happen to one of them, the other may be faced with serious financial hardship. A life insurance policy is an ideal way to ensure their future and protect their assets.

As nontraditional as it may be, life insurance is a wise and caring gift to purchase for many people.

Greg Rapelje

734-474-8398

[email protected]

9/22/2014 - A note from our Insurance Agent

Only Having Insurance“Through Work” Doesn’t Work

Do you know anyone whose life or career has drastically changed during these years of economic downturn? It’s very likely that someone in your immediate or extended family or group of friends is facing financial uncertainty. Maybe there’s a possibility that you (or your spouse) could lose your job or change employers.

Too many people have often relied on group term life insurance as their only safety net. Often, this insurance is an employee benefit provided at low or no cost. The existence of this coverage might convince someone that personally-owned life insurance is not necessary.

But only having “through work” insurance can leave you and your family vulnerable. Most group life insurance policies are limited in amount, which may be tied to salary or some other benchmark. These numbers are often capped, and this cap may be dangerously low when compared to your family’s actual needs. In fact, a detailed needs analysis that evaluates your specific situation, will likely show that any employer-provided coverage falls short.

In addition, the amount of group insurance offered is almost always reduced, sometimes dramatically, when you retire. You could one day find yourself without coverage, and if your health has changed (which it will as you age), you might also find yourself unable to secure individual protection. At the very least, it will definitely be more expensive.

While group life insurance can help, it does not replace the need for individually owned life insurance. I’ll be happy to meet with you and provide a no-cost needs analysis, so you’ll know exactly where you stand.

Greg Rapelje

734-474-8398

[email protected]

Only Having Insurance“Through Work” Doesn’t Work

Do you know anyone whose life or career has drastically changed during these years of economic downturn? It’s very likely that someone in your immediate or extended family or group of friends is facing financial uncertainty. Maybe there’s a possibility that you (or your spouse) could lose your job or change employers.

Too many people have often relied on group term life insurance as their only safety net. Often, this insurance is an employee benefit provided at low or no cost. The existence of this coverage might convince someone that personally-owned life insurance is not necessary.

But only having “through work” insurance can leave you and your family vulnerable. Most group life insurance policies are limited in amount, which may be tied to salary or some other benchmark. These numbers are often capped, and this cap may be dangerously low when compared to your family’s actual needs. In fact, a detailed needs analysis that evaluates your specific situation, will likely show that any employer-provided coverage falls short.

In addition, the amount of group insurance offered is almost always reduced, sometimes dramatically, when you retire. You could one day find yourself without coverage, and if your health has changed (which it will as you age), you might also find yourself unable to secure individual protection. At the very least, it will definitely be more expensive.

While group life insurance can help, it does not replace the need for individually owned life insurance. I’ll be happy to meet with you and provide a no-cost needs analysis, so you’ll know exactly where you stand.

Greg Rapelje

734-474-8398

[email protected]

8/14/2014 - A note from our Insurance Agent

Don't Assume You Can't Afford Disability Income Insurance

One of the biggest mistakes you can make regarding disability insurance is to assume you can't afford it or you won't qualify. Before you make that assumption, do some basic research and apply for coverage through the Knights of Columbus. The Order’s Income Armor product gives you options that can help you fit this critical protection into your risk management budget.

Here are two ways you can reduce your premium:

1. Choose a two-year or five-year maximum benefit period.

Depending on your age, the best option is probably a policy that pays benefits until you reach age 67. But a two-year or five-year duration benefit period would cover disabilities you might encounter in your working life.

2. Choose a longer elimination period.

An elimination period is the number of days a total disability must exist before benefits begin to accrue. Typical elimination periods are 30, 90, or 180 days. Choosing a longer elimination period lowers the policy’s premium. But be sure you have enough set aside in your contingency fund to account for the longer gap.

As your professional insurance agent, risk management is my specialty. Let’s talk about how to protect your income, your retirement needs, and your family's financial future.

Greg Rapelje

734-474-8398

[email protected]

Don't Assume You Can't Afford Disability Income Insurance

One of the biggest mistakes you can make regarding disability insurance is to assume you can't afford it or you won't qualify. Before you make that assumption, do some basic research and apply for coverage through the Knights of Columbus. The Order’s Income Armor product gives you options that can help you fit this critical protection into your risk management budget.

Here are two ways you can reduce your premium:

1. Choose a two-year or five-year maximum benefit period.

Depending on your age, the best option is probably a policy that pays benefits until you reach age 67. But a two-year or five-year duration benefit period would cover disabilities you might encounter in your working life.

2. Choose a longer elimination period.

An elimination period is the number of days a total disability must exist before benefits begin to accrue. Typical elimination periods are 30, 90, or 180 days. Choosing a longer elimination period lowers the policy’s premium. But be sure you have enough set aside in your contingency fund to account for the longer gap.

As your professional insurance agent, risk management is my specialty. Let’s talk about how to protect your income, your retirement needs, and your family's financial future.

Greg Rapelje

734-474-8398

[email protected]

6/30/2014 - A note from our Insurance Agent

The following story tells of the dangers of waiting to buy personal insurance.

This is the story of a young professional who was working for a Fortune 500 Company. As part of his benefit package, he had large amounts of group term life insurance. He was very active playing sports and taking adventurous vacations. But at age 39, during a stress test, doctors found three coronary arteries that had significant blockage. The doctor inserted three stents and everything seemed back to normal.

About 10 years later, this professional was laid off due to company reorganization. Most of the insurance, except for $65,000, was now gone. The $65,000 was going to drop by 35% at age 65 and the price was rising every five years, leading to a very high premium by age 65. He assumed that since he was healthy now that he could still get new insurance, at a later date, so he let the policy lapse.

Upon applying for a policy with the Knights of Columbus, he was declined as uninsurable due to the previous health issues. He verified this with another company. Luckily the K of C were able to offer a guaranteed issue policy for $7,500 so he has some life insurance, but less than he needs.

This is my story. Do not make the errors in judgment that I made. You may have great coverage at your current job, and in some instances it may even have the option for you to take it with you. But since the results of your decision affect not only you but your family, please use your fraternal benefit of having an insurance professional look at your policies. I have learned from my mistakes and have helped people make informed decisions on their financial well being.

Remember in most instances you are never healthier or younger that you are right now.

Greg Rapelje

Field Agent - 734-474-8398

[email protected]

The following story tells of the dangers of waiting to buy personal insurance.

This is the story of a young professional who was working for a Fortune 500 Company. As part of his benefit package, he had large amounts of group term life insurance. He was very active playing sports and taking adventurous vacations. But at age 39, during a stress test, doctors found three coronary arteries that had significant blockage. The doctor inserted three stents and everything seemed back to normal.

About 10 years later, this professional was laid off due to company reorganization. Most of the insurance, except for $65,000, was now gone. The $65,000 was going to drop by 35% at age 65 and the price was rising every five years, leading to a very high premium by age 65. He assumed that since he was healthy now that he could still get new insurance, at a later date, so he let the policy lapse.

Upon applying for a policy with the Knights of Columbus, he was declined as uninsurable due to the previous health issues. He verified this with another company. Luckily the K of C were able to offer a guaranteed issue policy for $7,500 so he has some life insurance, but less than he needs.

This is my story. Do not make the errors in judgment that I made. You may have great coverage at your current job, and in some instances it may even have the option for you to take it with you. But since the results of your decision affect not only you but your family, please use your fraternal benefit of having an insurance professional look at your policies. I have learned from my mistakes and have helped people make informed decisions on their financial well being.

Remember in most instances you are never healthier or younger that you are right now.

Greg Rapelje

Field Agent - 734-474-8398

[email protected]

4/7/2014 - A note from our Insurance Agent

Brother Knights, it is an honor to be selected as your new Field Agent for the Msgr. Kern Council #8284. I have been serving councils in Taylor, Dearborn and Livonia over the past year. I am a Michigan product, having graduated from St. Michaels in Livonia, Livonia Franklin and U of M Dearborn. My prior career was in Corporate Accounting, so I understand current cash flow but also the need for long term planning. I look forward to serving you and your family with knowledge and understanding. May God Bless you and your family.

Sincerely,

Greg Rapelje, Field Agent

Knights of Columbus

11292 Hubbell St.

Livonia, MI 48150

734-474-8398 phone

888-880-9708 fax

Brother Knights, it is an honor to be selected as your new Field Agent for the Msgr. Kern Council #8284. I have been serving councils in Taylor, Dearborn and Livonia over the past year. I am a Michigan product, having graduated from St. Michaels in Livonia, Livonia Franklin and U of M Dearborn. My prior career was in Corporate Accounting, so I understand current cash flow but also the need for long term planning. I look forward to serving you and your family with knowledge and understanding. May God Bless you and your family.

Sincerely,

Greg Rapelje, Field Agent

Knights of Columbus

11292 Hubbell St.

Livonia, MI 48150

734-474-8398 phone

888-880-9708 fax

Knights of Columbus Insurance

Since our founding in 1882, the primary mission of the Knights of Columbus has been to protect families from the financial ruin caused by the death of the breadwinner.

In the beginning, Venerable Father Michael J. McGivney and his fellow Knights “passed the hat” to benefit widows and orphans.

From that humble start, the Order has grown to include top-rated life insurance, long-term care insurance and retirement products.

With more than $92 billion of insurance in force and a full-time field force of more than 1,400 serving our members and their families, we are proudly fulfilling Fr. McGivney’s vision.

The best way to learn about our products is by arranging a visit with a local field agent. Your agent can custom design an insurance program to meet your current needs, help you plan for the future or simply explain the many fraternal benefits that come with membership.

To learn more about insurance or our products, please use the links on this page. To get a rough estimate of the amount of life insurance protection you and your family need, use our Life Insurance Calculator. The Knights of Columbus is Your Shield of Protection for Life.

Since our founding in 1882, the primary mission of the Knights of Columbus has been to protect families from the financial ruin caused by the death of the breadwinner.

In the beginning, Venerable Father Michael J. McGivney and his fellow Knights “passed the hat” to benefit widows and orphans.

From that humble start, the Order has grown to include top-rated life insurance, long-term care insurance and retirement products.

With more than $92 billion of insurance in force and a full-time field force of more than 1,400 serving our members and their families, we are proudly fulfilling Fr. McGivney’s vision.

The best way to learn about our products is by arranging a visit with a local field agent. Your agent can custom design an insurance program to meet your current needs, help you plan for the future or simply explain the many fraternal benefits that come with membership.

To learn more about insurance or our products, please use the links on this page. To get a rough estimate of the amount of life insurance protection you and your family need, use our Life Insurance Calculator. The Knights of Columbus is Your Shield of Protection for Life.